Asset-Limited, Income-Constrained, Employed

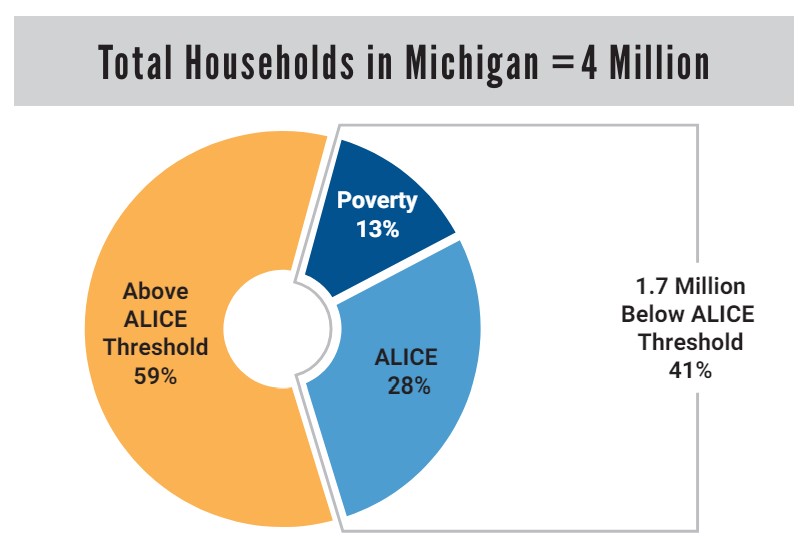

May 22, 2024 - ALICE in the Crosscurrents: An Update on Financial Hardship in Michigan shows that a total of 41% of households in Michigan were below the ALICE Threshold (Poverty + ALICE divided by the total households).

ACROSS MICHIGAN, 41 PERCENT OF HOUSEHOLDS STRUGGLE TO AFFORD THE BASIC NECESSITIES OF HOUSING, CHILD CARE, FOOD, TECHNOLOGY, HEALTH CARE AND TRANSPORTATION.

That's why United Ways across Michigan, with help from the Consumers Energy Foundation, have come together to bring you the ALICE Project.

The ALICE Report is the most comprehensive depiction of need in Michigan to date. In the years since the Michigan Association of United Ways released its first ALICE Report, Michigan residents have started to get a clearer picture of their neighbors, loved ones, friends, and acquaintances than ever before.

Many families across Ionia and Montcalm Counties are struggling to make ends meet.

Can you balance money and stress for 30 days?

CLICK BELOW TO TRY OUR ONLINE POVERTY SIMULATOR

"The ALICE simulation was incredibly stressful, in some situations there was only one option in which we were able to choose which set back on money quickly. I faced challenges like deciding to take my child to the doctor for an illness, or missing a family member's funeral or going to work. It didn’t matter what choice you made, they both came with negative consequences. It was hard for me to choose a promotion over spending more time with the kids. That decision ultimately maxed me out on stress. I thought the quick choice of making more money would help the family. I do know people who live similarly to this. Most of my relatives live this way. This simulation has encouraged me to make better financial choices and to closely monitor a budget to help ensure I don’t have to endure this stress." - High School Student

"It was really stressful to have to choose between everything. I felt kind of frustrated throughout the whole thing. It was really interesting that stress was a big part of the simulation, it makes a lot of sense to have that be a part of it. I faced a lot of problems where I could spend money or have a lot more stress. It was also difficult to choose what was important enough to spend on. I do know people that have lived this way. I believe that by being aware of needs and wants I will be better prepared for myself financially. I think that it will also be helpful to know how to budget before I get myself into any trouble. " - High School Student

"This simulation was a roller-coaster of emotions, but the two most common emotions I felt constantly were nervousness and frustration. I think the some of the most difficult decisions I had to make here was ignoring my beloved cat Fiona’s illness, opting to stay in my mold-infested apartment, and blowing off the credit card company because a) I love animals and hate it when they suffer, b) ignoring your health and safety because you can’t afford to live anywhere else is incredibly sad to think about, and c) ignoring a credit card company (especially when you owe them tons of money) is one of the scariest things I think a person can experience. Although I don’t know someone personally who has experienced these struggles, I feel that I can sort of understand what it feels like to experience these hardships by going through these sorts of situations. I think one of the biggest ways I can prepare myself for unexpected expenses and future situations is to budget my money early and develop good spending habits early on in my adult life." - High School Student

ALICE Reports &Resources

- 2023 ALICE IN THE CROSSCURRENTS (COVID AND FINANCIAL HARDSHIP)- MICHIGAN

- 2023 ALICE IN THE CROSSCURRENTS (COVID AND FINANCIAL HARDSHIP)- MONTCALM COUNTY

- 2023 ALICE IN THE CROSSCURRENTS (COVID AND FINANCIAL HARDSHIP)- IONIA COUNTY

- 2021 ALICE IN MICHIGAN (A FINANCIAL HARDSHIP STUDY)

- UNITED FOR ALICE: ALICE and COVID-19 (WEBSITE)

- 2019 ALICE SNAPSHOT REPORT- IONIA COUNTY, MICHIGAN

- 2019 ALICE SNAPSHOT REPORT- MONTCALM COUNTY, MICHIGAN

For more information please visit: United for ALICE

![]()

.jpg)

.jpg)